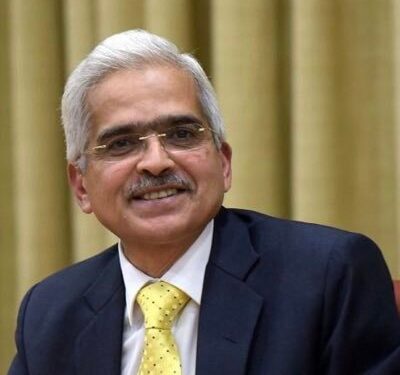

The Reserve Bank of India (RBI) Governor Shaktikanta Das recently held a meeting with the Managing Directors (MDs) and Chief Executive Officers (CEOs) of public sector banks and select private sector banks in Mumbai. In the meeting, he urged the banks to intensify their efforts against ‘mule accounts’ and to ramp up customer awareness and educational initiatives to curb digital fraud.

A mule account, typically created by one person but operated by another, is often used for illegal activities such as money laundering and tax evasion. These accounts violate numerous regulations, including the Prevention of Money Laundering Act (PMLA), tax laws and rules set by both SEBI and the RBI.

Das also emphasised on the necessity for banks to ensure robust cybersecurity controls, and to manage third-party risks effectively. The meeting addressed several pressing topics, including the persisting gap between credit and deposit growth, liquidity risk management, asset-liability management (ALM) issues, trends in unsecured retail lending and strategies to combat digital fraud.

Additionally, discussions covered the strengthening of assurance functions, enhancing credit flows to MSMEs, increasing the use of the Indian Rupee for cross-border transactions and banks’ participation in RBI’s innovation initiatives. He also highlighted the importance of further strengthening governance standards, risk management practices, and compliance culture within banks.

The RBI’s proactive stance aims to safeguard the financial system against fraud and enhance the overall security and reliability of banking operations in India.