US-based customer and employee engagement software provider Freshworks reported a 37% jump in its third quarter (Q3) revenue in terms of constant currency, even as operating losses widened to $3.1 million year-on-year (YoY), amid a tight macro environment marked by high inflation, greater scrutiny on tech spending, and recessionary trends across the western markets.

Freshworks beat analyst estimates to report $128 million in revenue in the quarter-ended September 30, and held its annual guidance at $494-496 million, even as losses touched $3.1 million, up from $1.5 million last year. Freshworks had guided that its Q3 losses would come in at $12.5-14.5 million. Sequentially, operating losses had stood at $15.4 million in the previous quarter.

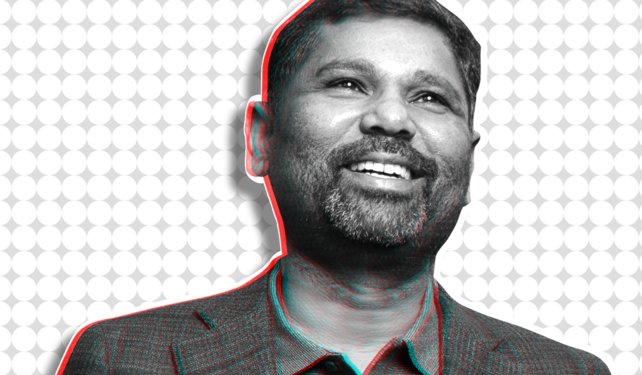

“The overall macro is tough for all companies. We’re dealing with high energy prices and inflation across economies, recession in North America, hiring freeze and layoffs at companies. Given that macro environment – to which we are not immune – we have managed to grow our business 37% and do it efficiently,” told chief executive officer Girish Mathrubootham.

Mathrubootham said the company has managed to arrest customer churn in the Small and Medium Business segment, largely due to special initiatives by the company’s customer success teams to enable customers to enhance software usage effectiveness.

In the software-as-a-service (SaaS) space, paying customers suspend subscriptions for various reasons, which companies refer to as “churn.” In the earnings call, Freshworks said it was seeing heightened customer churn in the SMB segment even as the mid-market enterprise segments showed resilience.

Freshworks said the number of customers accounting for over $5,000 in Annual Recurring Revenue (ARR) jumped 23% in terms of constant currency in Q3.

Over 24% of Freshworks customers use more than one product from the stable, indicating growing multi-product adoption. Mathrubootham said 57% of Freshworks’ customer base was mid-market and enterprise customers.

Freshworks categorises companies with 250 employees or fewer as the SMB segment, which takes up 43% of its customer base. It has added over 1,700 new customers in the September quarter.

Mathrubootham said Freshworks’ value proposition lay in offering simple-to-use software that competes with “bloated” offerings from larger players that add “wasteful complexities”. In a spending environment, where companies are looking closely at software purchases, Freshworks has been gaining against its peers, he said.

Recently, Freshworks appointed former Dropbox COO Woodside Dennis as president, leading global operations and strategy. Dennis would report to Mathrubootham.

Mathrubootham had set $1 billion dollars in annual revenue as a key milestone for Freshworks, just above twice the revenue it has guided for the current year. The company said it would grow its revenue 28% constant currency to $131 million in the last quarter of the current year.